3 Payroll Audit Ideas To Start The New Year

While closing the books on 2020, the New Year is a great time to review payroll and tax configurations. We put together a list of payroll audit ideas to get you on track and confident about your payroll data as we move into 2021.

Payroll Audit 1: Conduct a full review of account configurations that impact payroll data:

Unemployment Rate Updates:

Every new year brings new unemployment rate updates. Send rate notices to OnePoint as soon as possible. Our team will help change the rate within your account. If a rate change occurs after January 1, a reconciliation payroll must be processed to update any 2021 data.

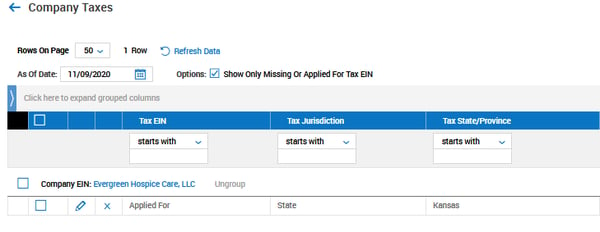

Missing Tax IDs:

Now is a great time to audit missing tax IDs. These are company tax accounts that have no tax ID entered or have the tax set to “Applied For.” Company taxes that are considered missing IDs create a large risk for clients. Many tax agencies will reject payments and/or returns when there is not a valid tax ID number. This can result in fines, penalties, and interest charged by the agency (some states charge up to 15%).

To simplify managing your company taxes setups, we developed a quick and easy way to identify these taxes. OnePoint HCM Clients can find earning and deduction codes in your account by following this path: Admin >> Company Settings >> Payroll Setup >> Company Taxes >> Easily identify by using our new filter “Show Only Missing Or Applied For Tax EIN”

**Company taxes directly impact successful tax and payment filing. OnePoint Payroll clients must make all changes to company taxes through OnePoint.

Review earning and deduction codes settings:

Make a point to review your active earning and deduction codes. You want to be sure what you are using is applicable to your company and coded correctly for usage in new year payrolls.

Payroll Audit Admin Tip:

Within the Earning or Deduction page: Select Columns >> Add the following columns to the page W2 Box Type/1099 Box Type. Make any necessary changes. It is also best to inactivate any codes that will no longer be used.

OnePoint clients can check earning and deduction codes by following this path: Admin >> Company Settings >> Payroll Setup >> Earnings/Deductions

Reminder on 2020 earning codes related to COVID-19:

If you paid out Families First Coronavirus Response Act (FFCRA) earnings during 2020, make sure those codes are inactivated in 2021. FFCRA paid family and sick leave expired on December 31, 2020.

Payroll Audit Tip2 : Check your employee information and setup:

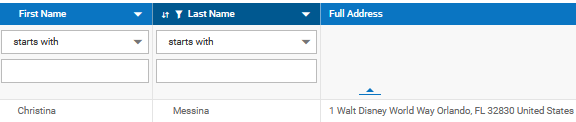

Employee names and addresses:

It is a best practice to make sure employees’ names and addresses are accurate. Send employees a reminder now to check their pay statements and direct deposit vouchers for updates and/ errors. Often employees forget to update addresses with their employers after a move. So remind everyone to double check their primary address, and while they are at it, their name is spelled correctly, emergency contact are updated, new cell phones numbers are correct, etc.

Pro Tip for Diacritical characters:

If employees names and/or addresses contain special characters (e.g., á, ñ, ü) these should also be removed. Diacritical characters in employee names and addresses will cause issues with tax filings.

A quick review of employee names and addresses can be conducted following this path: Team >> My Team >> Employee Information >> Use employee name columns and full address

Social Security numbers:

It’s always worth slowing down to enter employee data carefully. Social Security numbers (SSNs) are the perfect example. Incorrect SSNs will create issues with employee W2s and when filing tax returns and payments. You must enter the correct SSNs when adding new employees and verify that the numbers are properly formatted to match Social Security Administration (SSA) standards.

Key directives per the SSA:

- SSNs cannot begin with the following: 000, 666, or 9

- SSNs cannot be the following: 123-45-6789, 111-11-1111

- SSNs cannot have double zeroes for digits four and five, or end in four zeroes

Employee SSNs can be reviewed on your account following this path: Team >> Payroll >> Forms >> W2s >> Add SS# column

Tax elections:

It’s also important to confirm that your employees are coded correctly. Consider the following code selection examples:

- W2 employee versus 1099 contractor: Review the employee tax type for your employee to ensure it is correct

- Taxable or block withholding (W/H) or exempt: Incorrect tax coding on an employee can cause discrepancies with wages and taxes for your company and for your employee

Payroll Audit 3: Keep that payroll data in the green; run validation reports often!

Data validation: These reports help keep the health of your account in balance. Processing data validation reports monthly will help identify imbalances as well as corrections that may be needed. It can also help identify any incorrect configuration on your account, such as SUTA rates or employee-level setup issues.

Data validation reports are preloaded to client accounts. Access a full list of payroll audit reports by navigating to Team >> Payroll Forms >> W2s >> then click Saved: {System} Use these reports to identify any known discrepancies for each type of data validation.

Other Helpful Payroll Audit Reports

YE REVIEW Payroll Register YTD

- Ensure no negative balances in the YTD totals

- Ensure the hours and amounts are correct

- Ensure tax settings are accurate

- Review amounts for deductions, retirement plans, GTL, etc.

YE REVIEW W2 Code Deduction Assignment (company settings > payroll setup > deduction codes)

- Ensure the appropriate W2 Box Type is being populated for each deduction type

YE REVIEW W2 Code Earning Assignment (company settings > payroll setup > earning codes)

- Ensure the appropriate W2 Box Type is being populated for each earning type

YE REVIEW EE Data (Payroll > Forms > W2s)

- Verify Active AND terminated Employee Data – Name, Address, and SSN (NOTE: Address is what will print on the W-2)

YE REVIEW 1099 Data (Payroll > Forms > 1099 NEC)

Verify information for 1099 contractors – Name, Address, SSN or FEIN + Company Name. If you have independent contractors that were paid through payroll in 2020, OnePoint will automatically prepare form 1099-MISC.

These reports are available through a customer's "my saved reports" section. It's also good to run these at the beginning of the year after they run their first payroll to ensure earnings/deductions/taxes are computing the right calculations.

Conclusion

During any routine payroll audit, please reach out to OnePoint for assistance, if you ever find a discrepancy in your account that requires correction. We’re happy to help. We would rather be proactive and make a correction than risk additional issues happening in the future.

Subscribe to updates

Get the latest posts delivered to your inbox.