3 Ways HCM Software Demystifies Employee Benefit Enrollment

Employees are befuddled by their health care coverage. This leads to low engagement during enrollment season, and not selecting the best benefit options. But it is possible to demystify employee benefits. Use HCM technology to consolidate all benefits plans into one place and make it easier for employees to research, compare and sign up benefit plans.

A recent study by the International Foundation of Employee plans found only about one-third of employees (34 percent) have a solid understanding of their coverage options, while 15 percent have a "somewhat" or very low level of understanding. "Employers are aware and frustrated by it," said Dr. Arthur Leibowitz, chief medical officer and founder of Health Advocate, a provider of benefits programs based in Plymouth Meeting, Pa. Even though HR departments spend a lot of time organizing information for all their plans, put together the required summaries and other materials, he adds, “Employees don't pay attention to benefits until they need them or run up against a problem with them."

With so many employees working at home due to COVID-19, there are additional challenges with benefit enrollment. The possibility of in-person [information] sessions is limited. HR is less accessible for individual questions. At the same time there are new questions about benefits such as telemedicine coverage and testing for the coronavirus being covered in their plans.

Integrating benefits into an all-in-one HCM platform gives employers better tools to communicate benefit information and make it easier for employees to compare, and sign up for plans during benefit enrollment.

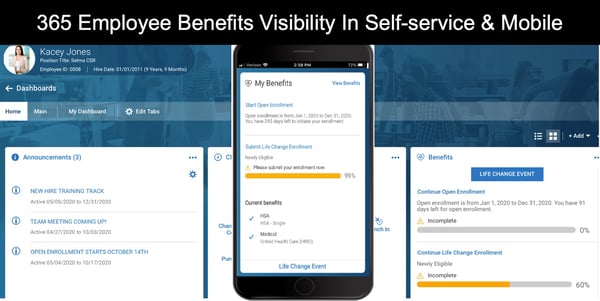

Consistent user interface for enrollment

Employees spend relatively little time enrolling in their benefits—18 minutes, on average, one study found, and 30 minutes or less, according to another. Basically employees just don't interact with the benefits process or the enrollment tools frequently. So when enrollment comes around, technology can actually become another barrier. Integrating benefit administration and enrollment into your HCM technology strategy can solve this user learning curve. Employees access enrollment through the same self-service portal they use for any other HR tasks and actions. The self service is also available on a mobile device or tablet making it easier to do research at home or on the go. Using a familiar user interface eliminates the anxiety and also creases better access to plan information and spend more time on research.

Compile all carrier and benefit plans into one platform

Depending on the number of benefits options you offer, another challenge can be that free enrollment tools can’t support all your benefit plans. This forces employees to undertake multiple processes to enroll in benefits. But if the process becomes too cumbersome or time consuming, employees are more likely to skip on benefits even if they would be beneficial. HR teams and business owners spend a lot of time creating benefits options that are simply ignored. Using OnePoint benefits plans and all the different options within each plan are configured for each enrollment year. You can load and configure any plans with hundreds of carriers whether it be Medical, Dental, Vision, Voluntary Life, Employer Paid Life, HSA, the possibilities are vast. We also offer direct lines (carrier connections) to hundreds of carriers, COBRA Administrator, FSA Administrator as well as your 401K Integrations for further automation of plan enrollment.

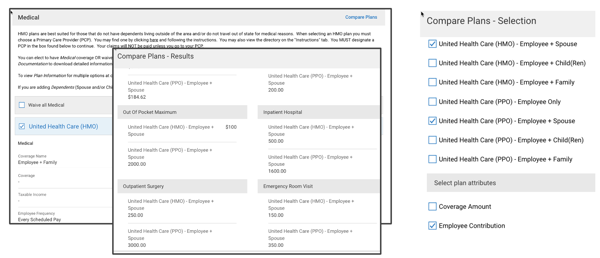

Efficient Plan Comparisons

Given the challenges of communicating benefits information, it doesn’t help that the marketplace is overflowing with benefits selections and is constantly changing. Employees typically don't spending the time to review plans or compare against other one it they have to compare using paper and printed summaries.

OnePoint HCM plan comparison tool is embedded within the benefits enrollment process. Compile all plan details, enrollment costs and deduction into the platform. Defined eligibility rules only allow employees to see plans that they are eligible to enroll. The comparison widget reveals premium calculations and coverage details to helps employees make better decisions when selecting health benefits. OnePoint can handle complex benefit plans making it virtually limitless. As an example we helped one client set up 70 different plan options under Cal Choice that were all age banded plans, AND the system was able to support all of it.

HR’s roll in the benefits process

Regardless of the process you have or the enrollment tool(s) you use, HR can play an instrumental role in assisting employees. Communication is key, and a multilayer communication strategy can create more engagement during open enrollment.

Any benefits portal should feature a summary of plan options, necessary forms, contact information, FAQs, a glossary of terms, explanations about HSAs and FSAs, resource links, and a calendar for enrollment dates or information sessions.

"Marketing" Benefits

By leveraging an “every channel available” approach to communicate benefits information you can accommodate different communication preferences. During open enrollment HR kind of becomes a marketing department. Be prepared with e-mails, webinars, postcards, fliers, videos, social media, mobile apps, meetings and workshops, and text messages. Also consider routine communication about benefits throughout the year. Benefits information and updates should be distributed year-round, not just before open enrollment or during onboarding.

Use Living Room Language

All benefits communication should use "living-room language," said Alison Caballero, director of the Center for Health Literacy at the University of Arkansas for Medical Sciences, in Little Rock. "This is a tall order that goes beyond writing at a lower reading level." For example, "say 'use' instead of 'utilize' and 'start' instead of 'commence,' " she explained. Language can also be another barrier if you have employees where English is a second language. Employer that take the extra effort to get benefits summaries and information translated can go a long way to help employees.

Make The Math Simple

Pay special attention to numbers in your presentations that tend to confound health care decisions, Caballero advised. In a survey by the nonprofit Kaiser Family Foundation, barely half of employees could calculate the amount they would have to pay out of pocket in a scenario involving deductibles and co-pays. "Make the math simple," Caballero recommended. "Use whole numbers rather than percentages, fractions or decimals" when feasible.

Employee Survey

A final best practice: Survey employees about the process after your benefits enrollment concludes, experts suggest. That will put you ahead for making improvements next year.

OnePoint Benefits Administration and Enrollment Tools

Contact OnePoint HCM to discuss implementing our benefits management solutions. We help simplify benefits administration and empower your employees by automating enrollment tasks and storing all your data in one place. Creating a unified cloud-based infrastructure for all of your benefit data will improve communication, boost enrollment and simplify the entire process for your entire organization.

Subscribe to updates

Get the latest posts delivered to your inbox.