5 payroll audit procedures ensure healthy payroll

Congratulations! You’ve officially submitted payroll. But don’t relax just yet. There are 5 simple payroll audit procedures that will improve the post-payroll process.

Making these steps part of your standard payroll process can alleviate stress surrounding ongoing payroll accuracy. Does your current payroll system have the capabilities to execute these audit procedures? Payroll is a critical process and it is important to have the right tools to process payroll and keep your payroll healthy.

1. Set the payroll email notification:

This seems pretty routine but does add a level of reassurance when payroll has been run. When payroll is finalized, workflows will send a notification email to the primary payroll administrator confirming “Payroll Has Been Finalized”.

This email further instructs the payroll administrator to review the Payroll Recap and Funding Report for the finalized payroll. More about this report in the second best practice.

Make sure to utilize auto-notifications as a helpful tool in your payroll audit procedures. Confirming that the payroll run is complete with additional process reminders provides confidence you’re keeping your payroll process healthy.

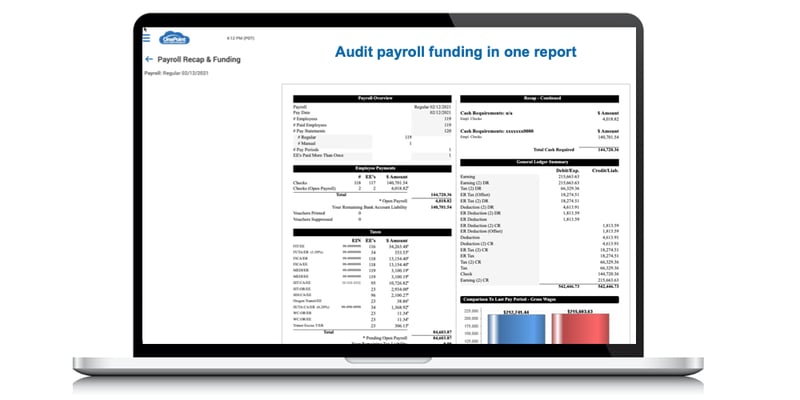

2. Review the Payroll Recap and Funding Report

The Payroll Recap and Funding Report displays all payroll payments by funding source and provides an overview of a given payroll. You should immediately review this report once you receive the payroll finalization notification email. This report will tell you the final amount needed to fund your current payroll. You can find this by locating the “Debit Section” on the report. Do not deduct voids from the Payroll Services Debit, as those are returned separately via ACH.

Where can you locate the Payroll Recap and Funding Report?

OnePoint HCM payroll users with find the Payroll Recap and Funding Report in the payroll system by following this path:

My Reports >> Payroll >> Payroll Recap & Funding

3. Review the payroll package

Once you receive your payroll package, open the package right away! Review your package to ensure all checks have printed as anticipated. If you locate any discrepancies, reach out to OnePoint immediately. We will work with clients to resolve any issues. Remember not to hand out paychecks before the pay date so they are not presented for early cashing.

**Pro Tip: Notify OnePoint Immediately about changes to the primary payroll contact or a change of delivery address. This is a pretty common sense reminder, but we are adding it anyway. We don’t want an administrative oversight to delay receipt of the payroll package.

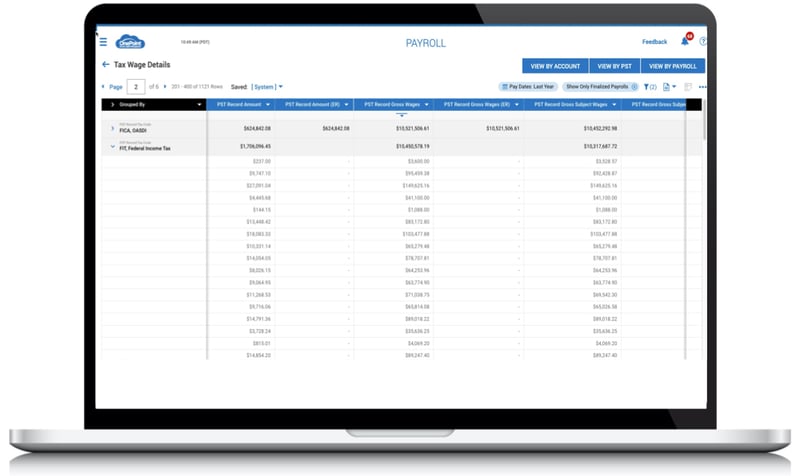

4. Utilize the Tax Wage Details Report

The Tax Wage Details Report is a crucial resource and should be your number payroll audit tool used after each payroll submission. This report shows all current payroll tax wages and liability. Adding this report to your payroll audit procedures will help keep data clean and balanced. It will also reduce those not-so-fun payroll surprises.

Reasons to run the Tax Wage Details Report:

- Identify all current wage and tax liability for the period

- Review for new or unexpected taxing jurisdictions

- Quickly balance for flat-tax percentages, including FICA/MEDI/FUTA/SUTA

- See many available column options, including employee detail

- Use to capture data for client-responsible taxes

Where can you locate the Tax Wage Details Report?

Locate the Tax Wage Detail Report by following this path:

Team >> Payroll >> Reports >> Taxes >> Tax Wage Details Report

You can customize the report by bringing in the columns you want to review.

*Pro Tip: Once you customize the report, be sure to save it as a VIEW for future use!

5. Rotate Data Validations Reports after each payroll

Data Validation Reports are used to review payroll data. They will help locate current data discrepancies or company/employee-level setup issues. Adding these to your post payroll process — or, at a minimum, running them for a couple of months — will help your payroll data accuracy. We recommend clients run data validations each month to confirm their data is accurate and balanced.

OnePoint Real-Time Payroll

OnePoint Payroll provides tools to run a wide range of payroll audit procedure to keep payroll data healthy at all times. Running payroll in an all-in-one HCM database reduces errors caused by data exports and lowers time spent dealing with exceptions and last-minute corrections common when work in batch payroll solutions. Real-time payroll calculations eliminate the preprocessing step, saving hours of manual work and convenient payroll audit tools. Contact OnePoint if you are interested in outsourcing payroll, our your customer service representative if you need help accessing these payroll reports.

Subscribe to updates

Get the latest posts delivered to your inbox.