Prepare for California Pay Data Reporting Requirements

On September 30, 2020, California Governor Gavin Newsom signed into law Senate Bill 973, which creates pay reporting requirements for employers. The law requires employers, (a) with 100 or more employees; and (b) that must file an annual Employer Information Report (EEO-1) under federal law, to submit an annual report to the DFEH. The report shall include the number of employees (and the hours they worked): By race, ethnicity, and sex; In each of the Job Categories in the federal EEO-1 Report; and Whose annual earnings fall within each of the pay bands used by the United States Bureau of Labor Statistics in the Occupational Employment Statistics survey.

The deadline for employers to submit pay data reports to DFEH on or before March 31, 2021, and then on or before March 31 each year thereafter.

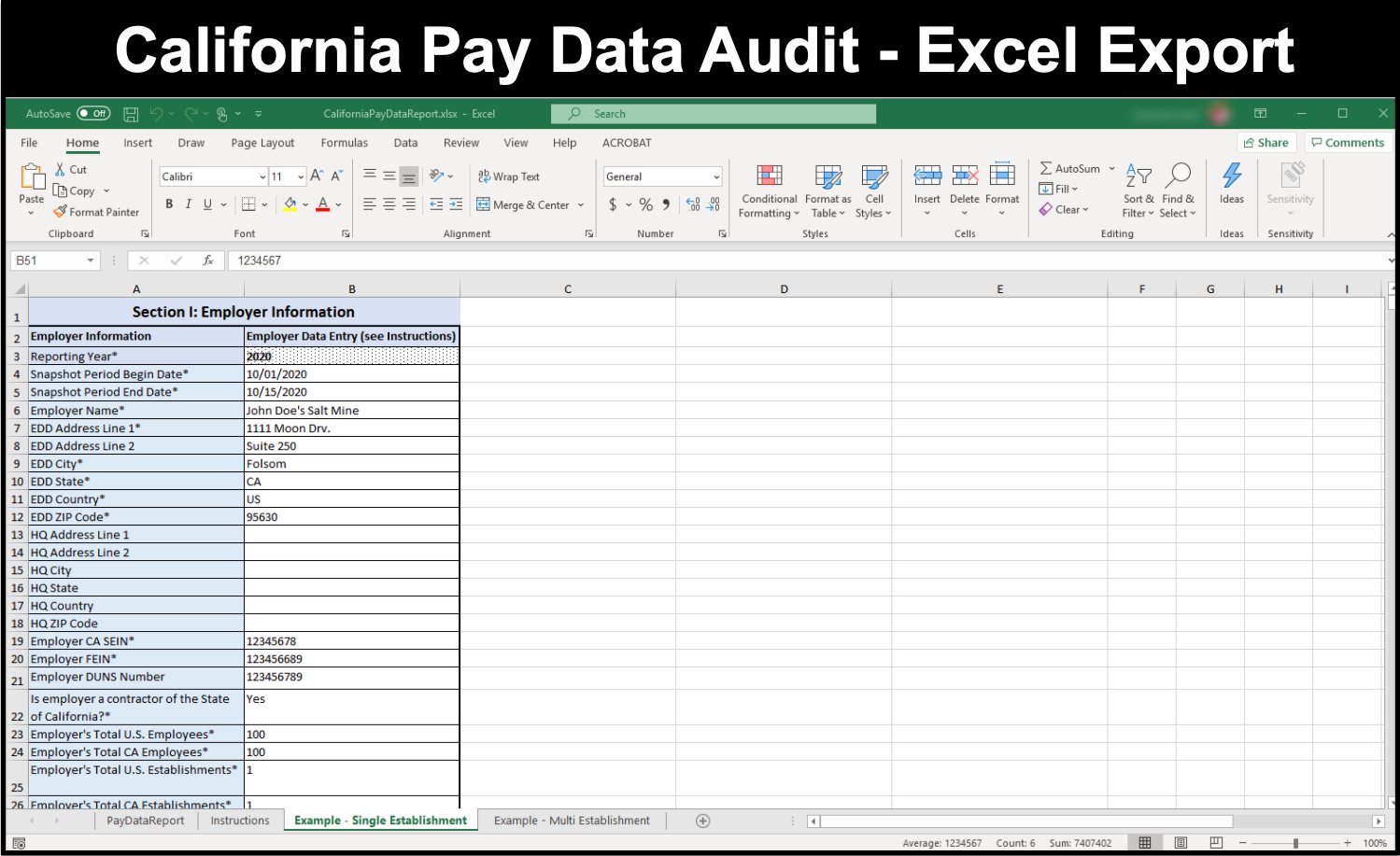

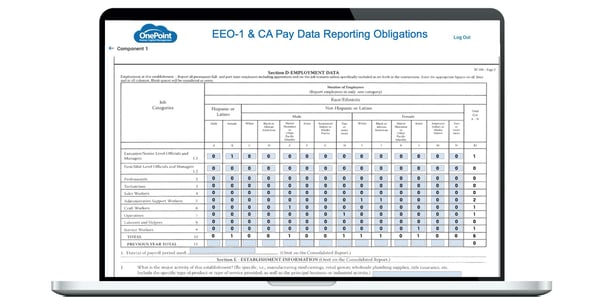

Streamline California Pay Data Reporting

OnePoint HCM reporting is ready to help our clients meet this new pay data reporting obligation. The EEO-1 report is one of hundreds of standard compliance report configured in the system. The single database architecture, and one employee record easily allows clients to blend employee demographic and timekeeping information with payroll data. Starting with the EEO-1 report, customize the data fields to display this set of complex data points. The reports are sortable by categories to comply with the reporting obligations for both regulatory agencies, DFEH and the EEO.

Automation and reporting features include:

|

|

Meet California pay data reporting submission requirements

DFEH did not release the submission portal until very close to the filing deadline. OnePoint's flexible, all-in-one architecture made it possible for OnePoint to design a tool that compiled the various data points from HR, payroll and timekeeping. The system was prepped and ready to generate formatted report ready for electronic submission and also provides a consolidated audit report to verify accuracy. This pay data tool allows for Pay Data reporting to be configured and adapted to the required file formats acceptable to the regulatory agencies.

Contact OnePoint to discuss the benefits of our Enterprise HR Module

DFEH pay data reporting requirements and clarifications

Due to the similarities of the EEO-1 and this new CA pay data reporting obligation, a lot of outstanding questions regarding CA SB 973 can be answered with the EEO-1 Instruction Booklet. The DFEH recently updated the Q&A site to provide clarification. Some specific topics mentioned are:

- Reporting methods of the following:

- Assigning employees to a job category

- Assigning employees’ race and ethnicity

- “Reporting Year” and “Snapshot Period” definitions.

Other clarifications established:

- Reporting obligations with clarification of multi-state employers and employers with employees who work or reside in other states.

- Employee Threshold

- Employee Counting methods: temporary employees and independent contractors.

-

What is the Definition of “employee” under the law?

(11/23/2020). For purposes of pay data reporting to DFEH, Government Code section 12999(m)(1) defines “employee” to mean “an individual on an employer’s payroll, including a part-time individual, whom the employer is required to include in an EEO-1 Report and for whom the employer is required to withhold federal social security taxes from that individual’s wages.

-

Who is obligated to file pay data reporting and what is required for multi-state employers and employers with employees who work or reside in other states?

(11/23/2020) Under Government Code section 12999(a), “a private employer that has 100 or more employees and who is required to file an annual Employer Information Report (EEO-1) pursuant to federal law shall submit a pay data report to” DFEH.

Employees located inside and outside of California are counted when determining whether an employer has 100 or more employees. See Cal. Code Regs., tit. 2, § 11008(d)(1)(C). For example, an employer that had 50 employees inside California and 50 employees outside of California during the Reporting Year would be required to submit a pay data report to DFEH. An employer with no employees in California during the Reporting Year would not be required to file a pay data report with DFEH. -

When determining whether an employer has 100 or more employees, an employer should count temporary workers provided by a staffing agency or independent contractors if the relationship falls under the definition of “employee” under the law.

(11/23/2020). For purposes of pay data reporting to DFEH, Government Code section 12999(m)(1) defines “employee” to mean “an individual on an employer’s payroll, including a part-time individual, whom the employer is required to include in an EEO-1 Report and for whom the employer is required to withhold federal social security taxes from that individual’s wages.”

- How to report on employees’ sex?

(11/23/2020) Under the Gender Recognition Act of 2017 (Senate Bill 179), California officially recognizes three genders: female, male, and nonbinary. Therefore, employers should report employees’ sex according to these three categories. Employee self-identification is the preferred method of identifying sex information. Unlike the EEO-1 Component 2 data collection from 2017 and 2018, DFEH anticipates that its sample form and instructions will require employers to report non-binary employees in the same manner as male and female employees.

- Which pay bands should an employer use?

(11/23/2020) Even though California has a higher minimum wage than is established under federal law, employers’ pay data reports must utilize the pay bands established by the U.S. Bureau of Labor Statistics (BLS) in the Occupational Employment Statistics survey, which currently are:

$19,239 and under

$19,240 – $24,439

$24,440 – $30,679

$30,680 – $38,999

$39,000 – $49,919

$49,920 – $62,919

$62,920 – $80,079

$80,080 – $101,919

$101,920 – $128,959

$128,960 – $163,799

$163,800 – $207,999

$208,000 and over

- And finally, can an employer submit a federal EEO-1 Report to DFEH to satisfy its obligation under Government Code section 12999?

(11/23/2020) Yes, but only if the EEO-1 Report “contain[s] the same or substantially similar pay data reporting information required” by Government Code section 12999. Government Code section 12999(g).

The DFEH pay data reporting Q&A page has been updated to include topics they intend on updating and clarifying on their website. The areas not yet clarified, but promised:

PAY, HOURS WORKED, MULTI-ESTABLISHMENT EMPLOYERS, ACQUISITIONS AND MERGERS, and SPINOFFS.

Bookmark the DEFH Pay Data Reporting Link and check back regularly to get the most up to date information on what you will need for the 2020 reporting obligation.

This intended for market awareness only, it is not to be used for legal advice or counsel.

Subscribe to updates

Get the latest posts delivered to your inbox.