HR Q&A: What is Unemployment Insurance Fraud?

The Covid-19 economic downturn caused a rise of unemployment insurance claims, which has provided increased opportunities for fraud and scams. The U.S. has lost more than $36 billion in unemployment benefits to improper payments, largely from fraud, since the CARES Act was passed in the spring.

Who is committing Unemployment Insurance fraud?

A recent article in Forbes estimates that fraudulent claims account for roughly 35% to 40% of new applications in some states1 . The most common is identity theft, whereby criminals steal personal data to file a claim in someone else’s name. The perpetrators are typically International organized crime rings from countries like China, Ghana, Nigeria and Russia account for most attacks.

How do the criminal actors get the data they use to file the fraudulent unemployment claims?

The most common unemployment insurance fraud occurs through identity theft. Criminals steal personal data to file an unemployment claim in someone else’s name. There are several best practices around data security, unfortunately most identity theft occurs when the victims releases or verifies their identity personal details through a scam. Phishing scams have increased during the pandemic so it is important to remind employees to avoid emails that look suspicious and not click unverified links in emails. However most employers won't become aware of unemployment insurance fraud until they receive a claim notice from a state unemployment agency.

How are employers affected by fraudulent unemployment claims?

As an employer, it is important to remain vigilant in auditing and reporting fraud to help identify and rectify this issue. The first way to prevent and solve issues of fraud starts first with the proper management of unemployment claims, such as responding to the claims in the allotted time frame, scrutinizing the claims to ensure the employee is no longer working for you but did work for you at some time.

Fraud affects Employers by resulting in:

- Benefit charges if not caught

- Increase in unemployment tax rate

- Trust fund decrease can result in unemployment tax rate schedule change (increase)

Our Unemployment Claims Management partner, Corporate Cost Control has put together a UI Fraud Guide with practical tips to both prevent and manage unemployment fraud claims.

What is being done at the state level to protect against fraudulent claims?

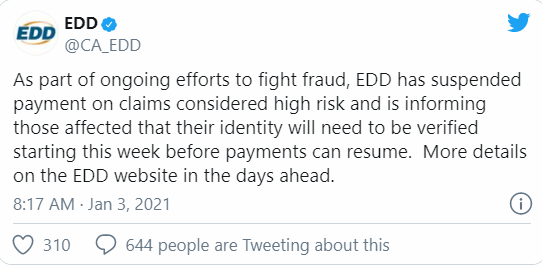

The $900 billion Covid relief law signed in December adds measures to fight criminals trying to steal unemployment benefits. By the end of January, states must put identity verification procedures in place and require workers to certify their specific COVID-related reason for needing assistance on a weekly basis. Workers will also only be able to back-date claims to the beginning of December instead of the spring, substantially reducing the overall payout.

States may experience delays at first as they make necessary tweaks to their systems. According to a Labor Department spokesperson, the agency is offering funding to support these efforts and states may request more, in addition to $100 million states received in August to fight unemployment Insurance fraud, according to the official. Current recipients will have to submit documents to verify employment — perhaps tax forms or pay stubs — within a 90-day time frame offered by the state. Applicants after Jan. 31 would have 30 days.

On January 3rd, California EDD tweeted:

What should employers do if they receive a fraudulent unemployment claim?

Clients of OnePoint HCM with Unemployment Claims Management service should immediately notify their Claims Analyst, who will notify the state unemployment agency. All other employers who become aware of a fraudulent unemployment claim, should immediately notify the state unemployment agency of the fraudulent claim and also notify the employee, if applicable. Below are links to the California EDD. The UI Fraud Guide contains a sample letter to notify your employees of fraudulent activity using their name / social security number.

Does OnePoint HCM have an Unemployment Claims Management Service?

OnePoint HCM provides a cost-effective unemployment compensation management program that minimizes the risk and resources required to respond to all unemployment claims, including fraud. Our partner, Corporate Cost Control, has 40 years of unemployment law experience giving you confidence that unemployment claims will be managed by experts who understand labor laws in all 50 states. Their team works with clients every step of the way, responding to all unemployment claims, auditing the unemployment account, assisting with appeal preparation and much more. Outsourcing the legal process eliminates dealings with Department of Labor, paper processing and minimizes the disruption to business operations.

Resources:

1 https://fortune.com/2020/11/25/pua-unemployment-insurance-fraud-dark-web/

https://edd.ca.gov/Unemployment/What_is_Unemployment_Insurance_Fraud.htmhttps://www.edd.ca.gov/About_EDD/EDD_Actively_Prosecutes_Fraud.htm

Subscribe to updates

Get the latest posts delivered to your inbox.