HR TIP: Avoid ACA liabilities and penalties in 2021 and 2022

Has your company’s liability for penalties under the Patient Protection and Affordable Care Act (PPACA or simply the ACA) increased due to COVID-19-related legislation? Here’s how you can reduce your penalty risk!

American Rescue Plan Act (ARPA) and Implications on the ACA

The three primary goals of the ACA have been to include making health insurance affordable and available to more people, expanding the Medicaid program to benefit Americans below 138% of the federal poverty line (FPL), and lowering the cost of healthcare through supporting innovative medical care delivery methods. Thus, Applicable Large Employers (ALEs), or those with 50 or more full-time employees (FTEs) or an equivalent combination of full-time and part-time employees, bear a shared responsibility in ensuring that 95% of their workforce has health coverage that meets the set standards as stipulated in the ACA.

However during the COVID-19 shutdown in 2020, the ARPA Act was released to aid households and businesses in shouldering the huge financial burden, and thus was expanded to include an individual eligibility for a premium tax credit. But this eligibility required ALEs to have an audit plan to avoid ACA liabilities and penalties in 2021 and 2022.

Prior to ARPA, if a person's household income was more than 400 percent of the FPL, he or she could not obtain a premium tax credit and the employer could incur a penalty. However, ARPA removed the 400% FPL cap when it comes to determining whether an individual is eligible for a premium tax credit. Because of this, any FTE who receives a premium tax credit could trigger an ACA penalty, thus increasing employer liability and exposure to incurring penalties.

Minimum-Value Coverage Calculations and “Assessing” the Penalties

According to the ACA provisions and minimum-value health, if an employee's share of the premium for employer-provided coverage is more than 9.78%, the coverage is not considered affordable for that employee. (This is because the affordable percentage indexed for inflation in 2021 is 9.83%.)

So, providing FTE-minimal essential coverage at a reasonable cost is paramount in being protected from ACA penalties.

Penalties will be imposed on any ALE in 2021 and 2022 whose FTEs are not supplied coverage at an affordable price, or if one or more FTEs are eligible for subsidized health insurance through an exchange). Failure to comply with any of the ACA provisions can result in IRS “play or pay” penalties (also called “employer shared responsibility rules”) for both nonprofit and for-profit organizations, which increased in August of 2020 from 2,000 to $2,700, and $3,000 to $4,060.

With these imposed penalties, each FTE receiving subsidized coverage through an exchange will incur a monthly penalty equal to $4,060 for the 2021 calendar year — divided over 12 months. The penalty, however, will not be higher than the monthly penalty that would apply if the employer did not provide any coverage at all ($2,700 divided by 12, multiplied by the number of FTEs employed during the applicable month, excluding the first 30 FTEs). Note that to determine the penalty, only FTEs are counted, not full-time equivalent employees.

See the IRS Q&A page for additional information on affordable and minimum-value coverage.

Avoiding ACA Anxiety by Reducing Risk

Employers should follow these guidelines when it comes to ACA reporting and penalties:

- Examine a monthly report of all FTEs to see who is enrolled in coverage.

- Examine their benefit plans to see if bare-minimum coverage is available at a reasonable cost.

- Keep track of which employees were offered coverage, but declined.

- Keep track of who has been offered coverage, but has denied it on a monthly basis.

- Keep track of who hasn't received a coverage offer on a monthly basis.

And since employers are generally not aware of their employees’ entire household incomes, they can use one or more of the three affordability safe harbors outlined in the final regulations, which are based on information that the employer will have, such as the employee's Form W-2, the employee’s rate of pay, and the FPL.

Knowing the penalties

An employer will be subject to a penalty if:

- The employer-sponsored coverage is unaffordable or does not provide minimum value,

OR

- If one or more full-time employees receive subsidized coverage through an exchange. (As noted above The ARPA removed the 400-percent FPL cap)

The monthly penalty is equal to $4,060 (for 2021) divided by 12 for each full-time employee receiving subsidized coverage through an exchange for the month.

However, the penalty will not be greater than the monthly penalty that would apply if the employer offered no coverage at all ($2,700 divided by 12, multiplied by the number of full-time employees employed during the applicable month, not counting the first 30 full-time employees). Only full-time employees, not full-time equivalents, are counted for purposes of calculating the penalty.

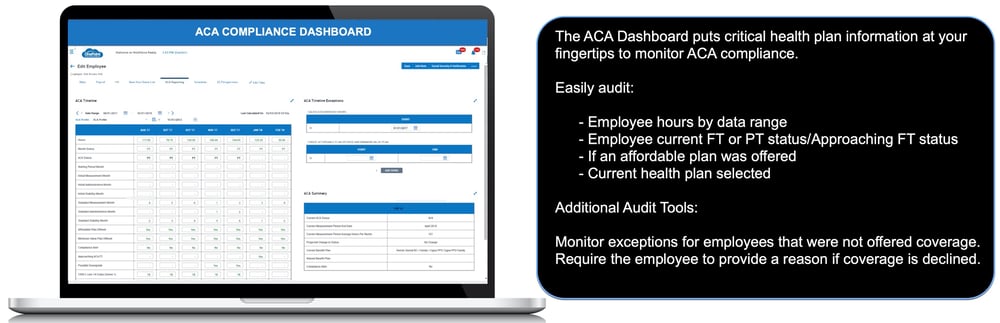

Simplify Employee Status and Benefit Plan Auditing

OnePoint reporting can make keeping track of this information a breeze! Using our Benefit Enrollment module allows you to keep track of employees who have enrolled in medical coverage and who have waived it. the system can even be configured to require the employee to enter a reason that they are waiving coverage. Our ACA Manager is able to track employees hours between measurement periods to help you better determine who may become eligible for coverage.

Subscribe to updates

Get the latest posts delivered to your inbox.